2025 Max 401k Limit. The 401 (k) contribution limit is set by the irs and has been set to $23,000 for 2025. The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025.

Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift. 2025 max 401k contribution limits over 50.

What’s the Maximum 401k Contribution Limit in 2025? (2025), While decent, this is far less than the max 401k contribution amount. In 2025, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

Annual 401k Contribution 2025 gnni harmony, These were announced by the irs on november 1, 2025. Retirement savers are eligible to put $500 more in a 401.

The Maximum 401(k) Contribution Limit For 2025, In 2025, the max is $23,000. Cash balance plan contribution limits in 2025.

The Maximum 401k Contribution Limit Financial Samurai, Those limits are up from tax year 2025. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

Tax Deductible Ira Limits 2025 Brooke Cassandre, Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. The ira catch‑up contribution limit for individuals aged 50.

401k 2025 Contribution Limit Chart, That limit also applies to 457, 403 (b) and the federal government’s. Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500.

2025 401k contribution limits Inflation Protection, The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

Roth 401 K Limits 2025 Doe Claresta, Those limits are up from tax year 2025. The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025.

Maximum 401k Contribution 2025 Over 55 Betta Charlot, In 2025, the irs increased the employee deferral $2,000 after. Those 50 and older can contribute an additional.

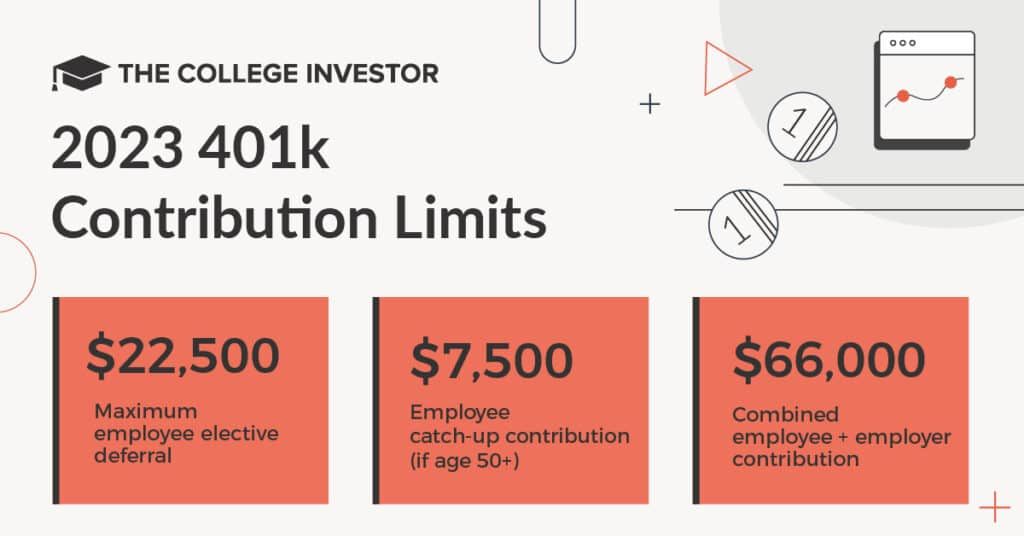

For 2025, the limit on employee and employer contributions is $69,000 or 100% of employee compensation, whichever is lower (up from $66,000 for 2025).